What’s the shape of your belief curve?

Takeaway

We draw our beliefs from others but are ultimately responsible for them ourselves.

Belief curves

We aren’t born with our beliefs.

We grow into them over time, influenced by our experiences.

It’s fun to debate nature vs nurture, biology vs behaviourism, genes vs epigenetics, but what we believe and how we behave is unquestionably influenced by others.

We aren’t sure what our beliefs are either.

We have a small set of strong beliefs, and a large set of vague ones.

It’s worth trying to write down all your core beliefs, the issues you feel most strongly about, your raison d’etre. If you’re like me, your list likely doesn’t extend much beyond 20 items [1]. Yet, based on that short list of ideals, we have to make decisions in reality.

We aren’t making decisions on just our beliefs alone.

We realise we don’t live in a simple single person scenario, but a complex society of people.

We both influence and are influenced by the actions of others, and over time define the cultural zeitgeist. Since we’re playing a relative status game, we need to consider what others believe. We behave in ways that we think will enhance our status in others’ eyes.

Most of our time is then figuring out what others believe.

In investing, we try to figure out what market consensus is. If you knew exactly where consensus was, you’d print money.

In tech, we try to figure out what customers desire. If you knew exactly what consumers would buy, you’d print money.

In life, we try to figure out what society demands. If you knew exactly what others wanted you to do, you’d print money.

“No way, I spend my time gathering as much information as possible, I adjust my bayesian priors, I’m a man of math”

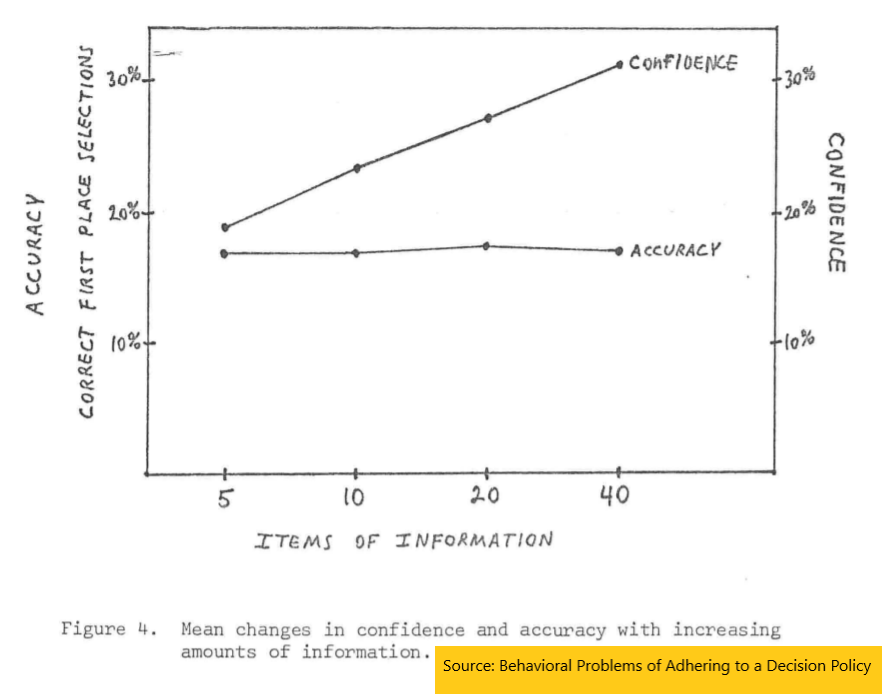

If so, would evidence showing that more information increases your confidence, but not your accuracy, affect how strongly you hold your beliefs?

The graph above comes from a study in which bettors were given different amounts of information. The more information they got, the more confident they got in their decision, as see by the upward sloping confidence line. However, that had little to no impact on the accuracy of their bets. More isn’t better, when it’s hard to evaluate the quality of the information.

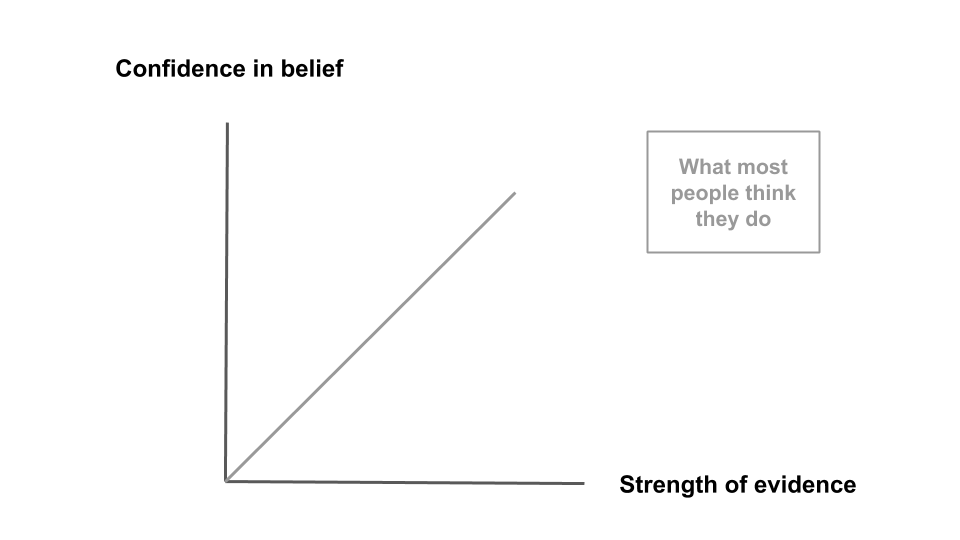

Most of us, myself included, like to think we’re well calibrated like the below:

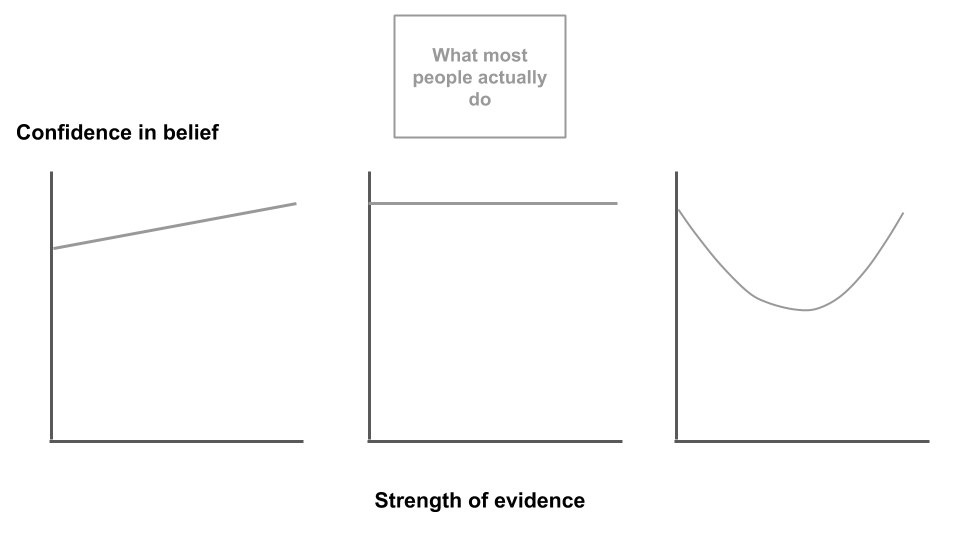

When we’re usually more like this instead:

“No way, I’m an independent thinker, I don’t care what others think, I’m a man of science”

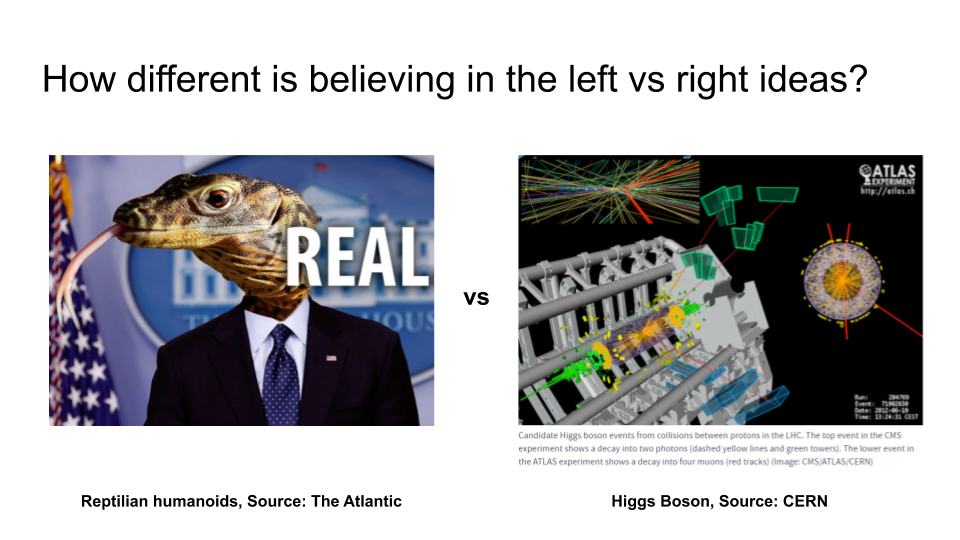

There’s less difference between you and someone who believes in lizard people. [2]

Let’s take something like the discovery of the Higgs Boson, a elementary particle in physics. As a man of science, you celebrated when you read the news that it was discovered. Another advancement for the ages.

How can you be so sure though? It’s based on a news report, from conclusions of a paper, of a study in advanced physics that you’re unlikely to understand, let alone replicate. Try as you might, you’re not going to be able to build another Large Hadron Collider in your backyard [3]. You have to assume that what others believe is true.

So that’s the bad news. You’re not much better than those of the lizard laity.

Here’s the good news. You still get to decide what you believe in, changing that as you learn more than before. You’re not fixed to any one opinion.

In those confidence vs evidence graphs above, it’s up to you to decide which type of graph you want to be. Whether that’s through steelmanning the other side’s arguments, doing an ideological turing test, or just reading and talking to more people outside of your comfort zone. The choice is yours, whether to change or be constant.

And while that does mean that some people will be reluctant to update their harmful beliefs, it also means that there’s always hope that they can change. We can help make that happen, by being a voice of reason. When enough people express their beliefs, over time that influences others to slowly change their minds.

Nobody’s born a racist; everybody can change.

I want to believe.

Footnotes

- For those unaware, I have a personal site as well in case substack goes away. There’s also other things I can post there like a list of websites I follow.

- The phrasing for polls like this can be bad, but even if you haircut the numbers by 99% there is still > 1 person who seriously believes in a lizard king.

- Well, if you somehow are able to build the next large particle accelerator in your backyard, I’d be happy to admit I’m wrong. You can even put my name down as the person who you had a bone to pick with and wanted to prove wrong.

Paid reader survey discussion

I did a survey on a small group of you paying subscribers; thank you to everyone who filled it out. The feedback was helpful in seeing what people have actually liked recently (the Josh Wolfe and the Picasso profiles came up often) and also for knowing what people want more of (more finance, more tech, more random interesting things).

It’s also flattering and frustrating to realise that people found the recent talk summaries boring, and would rather hear my opinion instead of CEOs. Given the amount of time involved in transcribing, summarising, and cleaning those up, vs the value that people are getting out of them, it makes sense to reduce the frequency of such posts in the future.

Sometimes I don’t add much to something because I don’t have a strong opinion, or a high enough conviction level in the point I want to make. However, I understand the desire for more of my personal voice, and will adjust this moving forward too. This also implies that future posts will naturally be things I’m less confident in, as I try to push the boundary of what I cover.

If there’s one thing I want to be known for, it’s that I listen to feedback seriously. I might not make all the changes that people want, but I will adjust to the extent possible so that this newsletter continues getting better. Many features of the current version were due to suggestions by readers like you, such as the takeaways up top or separate sections in the monthly. Keep the feedback coming, it’s much appreciated.

If you liked this, sign up for my finance and tech newsletter: